Off the back of researching financial figures for NIO, I came across Rivian’s financials and with a similar market capitalisation of $12 billion at the time of writing, but with a different market and product, I thought I would take a more in-depth look. Let’s jump in…

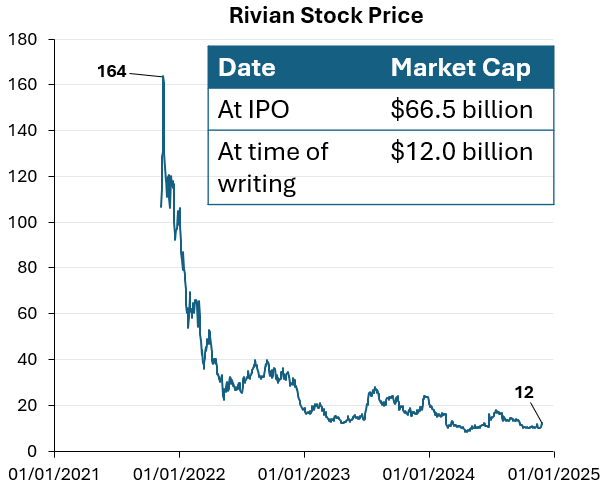

Rivian made the mainstay press with an IPO in November 2021 valuing the company at $66.5 billion which later increased up to over $100bn as investors bought the market hype. A steady decline since then now has the company at around 1/10th the peak value. But where could it end up in the future?

Enter Mainstream Motors

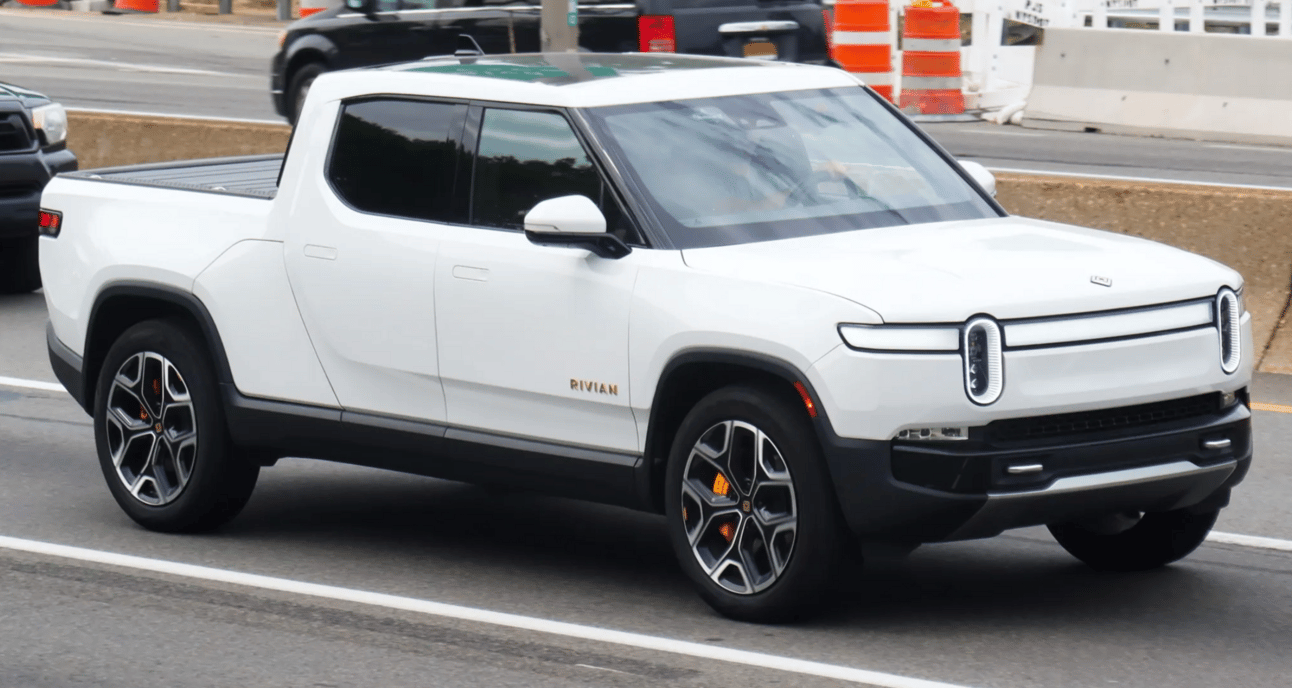

Rivian first started life back in 2009 under the name of Mainstream Motors with the objective of making a coupe hatchback. Initial photos of the full-size early clay model appeared in promotional material around 2011 but little can be found after this date. With Tesla, Lucid and others reportedly developing similar concepts, it didn’t take much more time to make the decision to differentiate by pivoting to a battery electric SUV pick up concept and the coupe was shelved.

Switching to a truck concept was in hindsight a wise move as light trucks account for a large majority of total vehicle sales in the US. In 2023, sales of light trucks accounted for about 79.9% of the approximately 15.5 million light vehicles sold with a burgeoning market outside the US also. Both domestic and global sales are increasing at similar rates but a conservative EV penetration remains; EV sales are expected to grow over the coming years with 34-36% CAGR forecasted from 2024 to 2030 depending on source.

Light Duty Vehicle Market Size Growth (Inc Passenger Cars, Pick-Ups, Light Duty Trucks)

A consumer-focussed electric pick up truck would be classified as a Class 1 (<2720kg) or Class 2 Light Duty Truck (<4535kg) according to the North American Truck Classification System. When specifically looking at this class of vehicle and current sales, it can be seen that US customers are buying domestically produced trucks with the majority of sales attributed to the Ford F-150, Chevrolet Silverado, Toyota Tacoma, Dodge Ram and GMC Sierra.

Strong domestic truck sales are partly driven by the import tariff named the ‘Chicken Tax’ which is a 25% tariff on light trucks (and originally on potato starch, dextrin, and brandy) imposed in 1964 by the United States under President Johnson in response to tariffs placed by France and West Germany on importation of U.S. chicken. All the other categories within the tariff have since been relaxed aside from trucks and so gives domestic manufacturers a competitive advantage in the US market.

Releasing a new challenger into this light duty segment was clearly going to be ambitious due to the brand loyalty of the incumbents, but differentiation through the battery electric powertrain, first mover advantage and additional features were great ways to potentially gain market share from the major players as as the time, no EV variants of the best sellers were commercially available.

The US government is also continuing to support the market adoption of electric vehicle by offering a credit towards the purchase price of the vehicle, although it is now split into two tiers. Of the 113 EV models available for sale in Q1 2024, 19 percent (22 models) are eligible for all or part of the credit: 13 models are eligible for the full $7,500 and 9 models are eligible for $3,750.

A tried and tested popular truck concept with an EV twist

The R1 vehicle was well received during its reveal in 2018 and around 70k pre-orders were made for the vehicle. Battery electric variants of the best sellers such as Ford F-150 did not break cover until much later but have since managed to recover ground, with competitors making official reveals of electric variants of the best-sellers through 2021 and 2022 (the other new competitor from Tesla, the Cybertruck was first unveiled in Nov 2019 and started deliveries 4 years later in Nov 2023). During the early years of production, Rivian managed to tally 9.9k fulfilled orders in 2022 and 19.4k in 2023. As can be seen from the US light duty pick up truck volumes, it would be ambitious to target around 50-60k sales per annum given the concentration towards established OEMs and their EV variants.

# | Model | Month | Month LY | YTD | YTD LY |

|---|---|---|---|---|---|

1 | Ford F-Series | 79872 | 70,841 | 834,641 | 750789 |

2 | Chevrolet Silverado | 53081 | 49,054 | 560,265 | 555148 |

3 | Ram Pickup | 37496 | 38,482 | 373,118 | 444927 |

4 | GMC Sierra | 34223 | 27,201 | 298,698 | 295738 |

5 | Toyota Tacoma | 22715 | 19475 | 192,813 | 234768 |

6 | Toyota Tundra | 14973 | 12513 | 159,528 | 125185 |

7 | Ford Maverick | 4382 | 7719 | 157,345 | 94058 |

8 | Chevrolet Colorado | 9801 | 4241 | 98,013 | 71082 |

9 | Nissan Frontier | 4989 | 4187 | 69,813 | 58134 |

10 | Ford Ranger | 5256 | 172 | 51,591 | 32334 |

… | |||||

15 | Tesla Cybertruck | 2,979 | 0 | 23,798 | 0 |

16 | Rivian R1T | 610 | 1,163 | 15,799 | 19,410 |

Areas of R&D and Focus Commodities

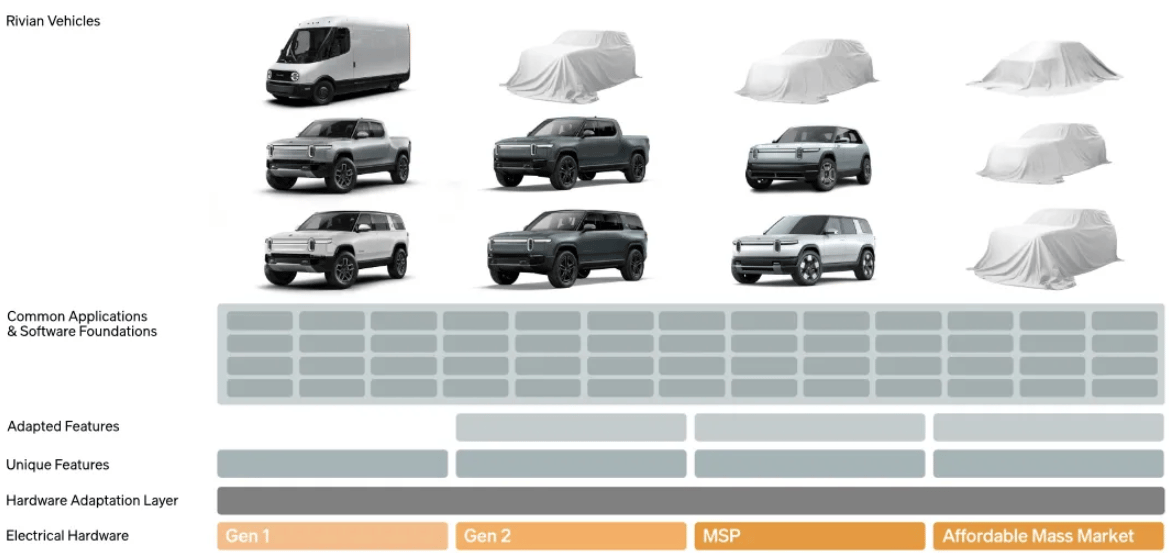

The R1 is now approaching the second generation of it’s life and these vehicles will integrate multiple new technologies such as a zonal network electrical architecture and Rivian’s updated autonomous technology, while targeting a 20% material cost reduction to an R1 . These technical updates, cost reduction and commodity sharing learnings will form the foundation for the midsize platform which will underpin the top-hat of the new planned models. The company is also planning to continue to develop the RCV commercial van platform for broader customers beyond Amazon.

Motors

Initially configured into dual and quad motor combinations with the previous Quad-Motor setup being supplied by Bosch. Rivian have started to produce their own electric motor families, the Enduro and Ascent motors, for cost and supply chain benefits (current lawsuit battle ongoing for early breach of agreement with Bosch to the tune of $204 million)

In terms of technical configuration of each variant, the dual motor is one large motor with one differential for each axle and the quad motor is four smaller motors with separate gear reduction and no differentials. All three major components of the EDU – motor, inverter, and gearbox – are assembled into a common casting, which has a lower cost of manufacturing.

A supply shortage of copper windings used in their Enduro motors impacted production outlook for the previous quarter (Q4 2024). This has been mitigated through directing customer sales to a new triple motor variant which uses one Enduro Motor and two Ascent motors which overall utilises much less copper winding material.

Electrical Architecture & Proprietary ADAS

The company is also planning to introduce an electric architecture of similar concept to other OEMs with zonal ECUs being utilised in the architecture that ultimately enables a reduction in the number of ECUs from 17 to just seven highly powerful ones.

A recent SEC filing reveals that VW holds nearly 83M Rivian shares which equates to roughly a 7.7% stake; the partnership, formalised through a joint venture, allows both companies to collaborate on next-generation EV platforms while maintaining their individual brand identities. Given VW’s announced losses of €2 billion just for 2024 alone, investing in Rivian enables access to their proprietary software and electrical architecture whilst sharing investment risks and manufacturing knowledge

Cost Down

Despite the great product concept, the vehicles are currently expensive in material cost and production, leading to a loss. Rivian is engaged in innovations to reduce cost on the existing R1 platform and scale up to enable cost reductions from increased volume

Product cost down will come from design optimisation by utilising a structural battery pack in the floor-pan, large structural die castings, further electronics consolidation enabling harness simplification. It is also worth noting that batteries will also be domestically manufactured with LGES supplying 4695 cylindrical cells.

Other developments that are changing the dynamics within the US truck market come under the new fiscal policy in the the Inflation Reduction Act (IRA) in two, basing eligibility on EVs meeting various critical mineral, battery component, assembly and income requirements.

Commercial success for the company is reliant on achieving higher sales volumes and building out production capacity

With the company making significant advancements in key commodities, another key element is reaching higher levels of sales volumes to match the more-than- capable planned manufacturing footprint and cover the associated fixed costs. As we established, competing for a large slice of the market using the R1 maybe a challenge and so moving into a new segment may be the answer… The Rivian R2 was announced in March 2024, penned as a challenger to Tesla’s Model Y (which tallied 394,497 sales in the US in 2023)

With a target starting price of around $45,000, this has potential to take a chip out of the current best selling US EV. With the segment growing, if they can conquest 10% of the volume from Tesla, this would be 39-40k units in the not-too-distant future.

Footprint Development: Expanding for New Model Lines

Back at the company inception near 2015, Rivian had received enough funding to operate research facilities in California’s Bay area, as well as Michigan. The latter soon became home to Rivian HQ to stay close to suppliers in the Midwest. Then in 2017, to manufacture the R1, the company had completed its purchase of a former Mitsubishi facility in Normal, Illinois which became its North American manufacturing hub; this facility currently has capacity to produce 200k vehicles annually.

most recently, they’ve been in the news with a notable institution and an OEM choosing to invest in developing the manufacturing footprint of the company; a $6.6 billion loan ($6 billion principal, $600 million capitalised interest) was given by the U.S. Dept of Energy to build a new factory in Georgia and VW Group has pledged to invest $5.8 billion into a joint venture. With an estimated $5 billion required to build the new factory, this capital will be utilised to provide the capital to fund operations through the ramp of R2 in Normal (originally planned for production in Georgia), as well as the midsize platform in Georgia. It is worth noting that this is the same factory on which construction was halted in March ‘24 when the company ran into financial issues and decided to re-alocate the capital to R2 development and minimise overheads. When completed, the new Georgia factory is slated to have an initial annual production capacity of 200k vehicles per year when opens in 2028, rising to 400k vehicles per year by 2030.

US sales will remain the focus and Rivian control 16 retail spaces across the country and 62 service locations.

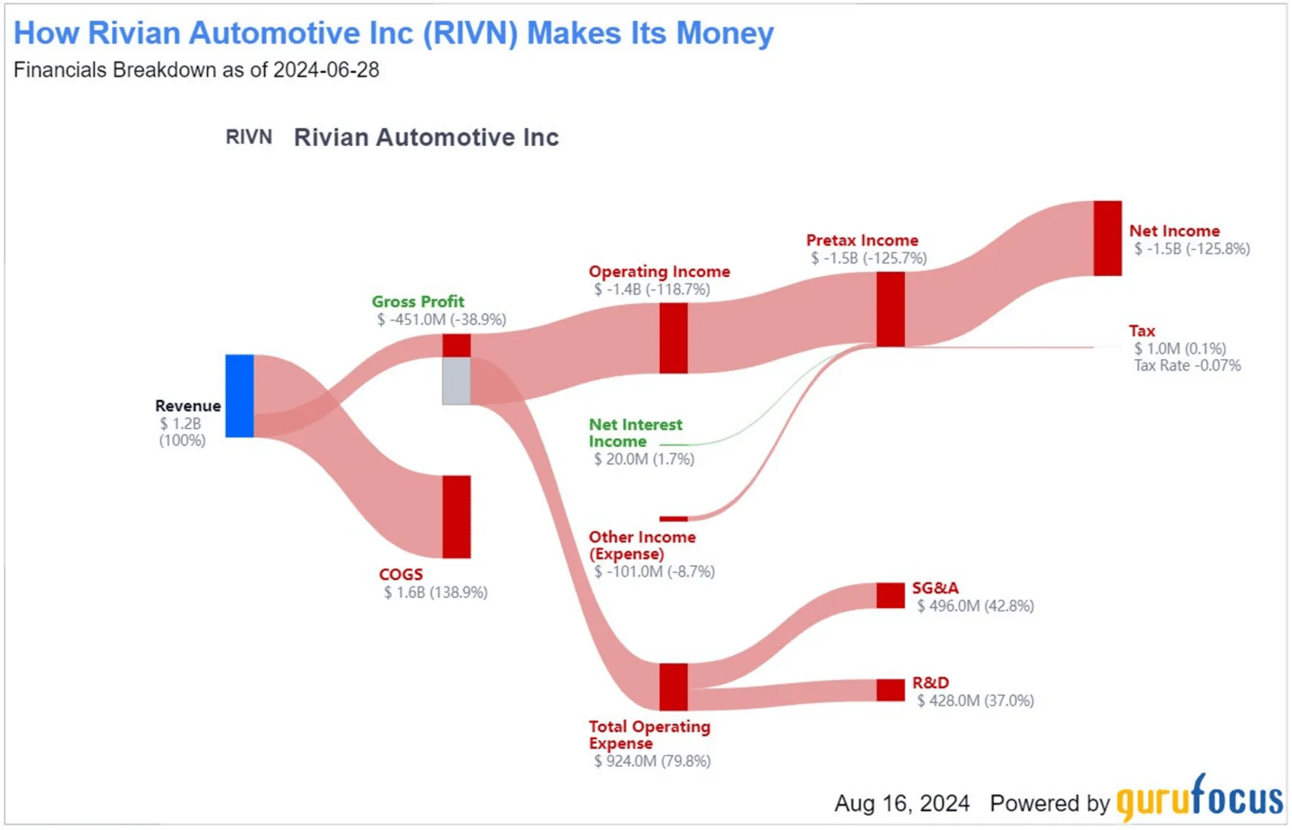

A path to profitability and a justified higher share price

Rivian recently released their Q3 2024 earnings; they posted a loss of $1.1 billion in Q3 2024 and has lost $4.0 billion in 2024 YTD. In the YTD, Rivian has delivered 37,396 vehicles, up 3% from the same period in 2023. Production volume in 2024 YTD is actually down 7% at 36,749 vehicles as Rivian has been working off excess inventory from 2023 when Rivian produced 7,110 more vehicles than it delivered. A straight line projection of the YTD production volumes over the balance of the year is 48k vehicles. The puts current production at just under 25% of Normal’s capacity.

Over the long-term, Rivian’s value will be determined by the scale it can reach with its midsize platform including the R2, R3, and R3X, as well as continuing to focus on cost reduction and developing innovative, differentiated technologies.

Short-term profitability is planned to come from higher revenue per unit from increased non-vehicle revenue (regulatory credits, service, software), better vehicle pricing mix with second-gen R1s and premium Tri-Motor models, lower costs through material cost reduction, better manufacturing efficiency and decreased inventory costs.

Over the longer term and assumptions on sales revenue, bottom up approximate volume assumption could spread 50k per annum in R1 ($80,000 USD) , 100k R2 ($55,000 ) and 10k Van ($80,000) with some new models and facelifts arriving to maintain and increase which gives an approximate 160k volume which is quite a bit short of the 400k volume that RJ Scaringe has declared will be capable.

What does this potentially mean for the share price?

As a very basic calculation and assuming they can fill up to 400k in production volume at an average price of 80,000USD mixed across R1, R2, R3, R3X, Van, and future models, this would generate around $32 Bn in top line revenue. Tesla achieved a similar number back in 2020 which resulted in an EBITDA of $4.3 Bn and a resultant Earnings-Per-Share of $0.25. As the majority of Tesla’s volume was manufactured at the Fremont, US factory, I’ve assumed that Rivian could achieve a similar gross margin around 20% by the time they fill capacity, match the EBITDA, and achieve a 2.3% net margin. This could result in around $700 Mn net income being available to divide amongst the 1.021 Bn shares outstanding, resulting in EPS of ~$0.70. Multiplying this up with a conservative EV OEM PE ratio of 35 gives a price range of $25-30, which is above where it is today at $13.85. The key question is, can the new factories and the 400k capacity be filled with the new planned variants?

A conservative outlook would be around the $20 mark in 2026 if volume increases steadily.

I’m personally very interested in researching and subsequently writing about the intersection between engineering and business. I’ll be writing more regularly in future for any followers on the platform and welcome any feedback or questions on the post above.

Thanks!